There seems to be no outrage from the public that First Islamic Investment Bank owns and operates Small Smiles Dental Centers. Why?

There is nothing close to the outcry when it was revealed this same bank owned Caribou Coffee. The bank simply changed its name to Arcapita, folks.

This investment bank is milking our CHIPS Medicaid system, designed to help low-income children. To the tune of $150 million dollars a year I might add.

They are taking this money and applying Shariah Compliant Finance laws, letting a group of Shariah advisers, from Pakistan and Saudi Arabia decide who gets the money and how much! Think it might be going to fund terrorist? (rhetorical question) Are you seriously OK with this!

More on Shariah Compliant Finance below.

Small Smiles, Kool Smiles, and Church’s Chicken

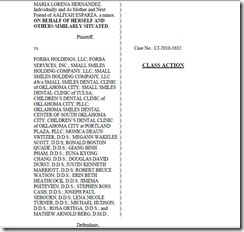

Arcapita B.S.C, the Islamic Bank that owns the Small Smiles Dental Clinics, notorious for over-treatment and the abuse of underserved children in the US.

Friedman Fleischer and Lowe the US Investment firm owns the Kool Smiles Clinics, it too, notorious for over-treatment and the abuse of underserved children in the US.

What do these two companies have in common besides the above?

They each have, at one time or another, owned Church’s Fried Chicken and employed Harsha V. Agadi and FFL’s Kool Smiles arm, NCDR, LLC is also based in Atlanta.

Arcapita purchased Church’s Chicken in December 2004. Arcaptia sold out to Friedman Fleischer and Lowe in June of 2009 for an undisclosed amount. FFL left l Harsha V. Agadi as President and CEO.

Harshavardhan V. Agadi

Currently Agadi is Chairman and CEO of Friendly Ice Cream and still remains a shareholder and board member of Church’s Chicken, through his company GHS Holding. Arcapita appointed Agadi as CEO in 2004.

Currently Agadi is Chairman and CEO of Friendly Ice Cream and still remains a shareholder and board member of Church’s Chicken, through his company GHS Holding. Arcapita appointed Agadi as CEO in 2004.

Agadi has a BS degree from of the U of B. No, that is not the University of Boston, its University of Bombay. I shall leave it to you to decode the BS degree. Harsha has been with Pizza Hut, Dominos, CEO of Little Caesar’s Pizza, and serves on the boards of Sbarro’s Pizza, and Bijoux Terner, another Arcapita company.

Agadi stepped down as President and CEO of Church’s Chicken in January 2010 and joined Friendly’s Ice Cream August 17, 2010. Harsha is also on the board of Crawford & Company, appointed August 5, 2010, twelve days before the appointment as CEO of Friendly’s Ice Cream.

Crawford and Company

Why are so many Arcapita Executives on Crawford and Company’s board? At least two are also members/directors of FORBA Holding.

Crawford and Company based in Atlanta and according to its website “…is the world’s largest independent providers of claims management solutions to the risk management and insurance industry as well as self-insured entities…”

Currently Harsha Agadi, from above, sits along side Jeffery T. Bowman, President of Crawford and Company, and Charles Ogburn, Crawford & Company board member and he also is with Arcapita.

Other Arcaptia employees or board members associated with Crawford & Company:

Charles H. Ogburn - Non-Executive Chariman – Arcapita, Alanta Venture Forum, Crescent (now Arcapita), Robinson-Humphrey Company, Durham Affordable Housing Coalition and King and Spalding, according to Zoominfo.com. Charles Ogburn earned $72,999.00 from Crawford and Company in 2009.

Charles H. Ogburn - Non-Executive Chariman – Arcapita, Alanta Venture Forum, Crescent (now Arcapita), Robinson-Humphrey Company, Durham Affordable Housing Coalition and King and Spalding, according to Zoominfo.com. Charles Ogburn earned $72,999.00 from Crawford and Company in 2009.

According to Bloomberg Business Week, Charles Ogburn is on the board of 6 companies:

American Pad and Paper, LLC

Cypress Communications, Inc

Southland Log Homes, Inc.

Caribou Coffee Company, Inc.

Tensar Corporation

Crawford and Company

Bloomberg lists Ogburn’s other affiliations and FORBA Holding is on the list.

Jeffery T. Bowman, Crawford’s President whose total compensation for 2009 was $1,270, 728.00.

Jeffery T. Bowman, Crawford’s President whose total compensation for 2009 was $1,270, 728.00.

Bloomberg fails to list FORBA Holding, LLC as one of Jeffery T. Bowman’s profile.

Shariah Law and Shariah Compliant Finance

Under Shariah Compliant Finance (SCF), 2.5% of all profits must be paid as “Zakat”. Under Islam, Zakat purifies your money, possessions and wealth and is one of the Five Pillars of Islam. Basically it purifies Muslims from any greed and selfishness. It is believed practicing Zakat protects future income, protects them from loss and hunger as well as ensures their prayers are heard by Allah.

This “ethical banking” forbids investments or owning interest in various business and products such as entertainment, pornography, gambling, pork, alcohol or any form of business that involves Israel.

Zakat is paid to Islamic charities. It is the clerics on the boards of these charities who decide what charity receives the Zakat and the amount. No doubt billions are handed directly or indirectly to jihadist. After all, Yusuf Al-Qaradawi was and reported still is Arcapita’s Shariah Financial adviser. I will get to Qaradawi in a minute.

Critics pounced on Caribou Coffee when it was revealed the majority shareholder was a Shariah Compliant bank when it was named First Islamic Bank of Bahrain, whose CEO is Atif Abdulmalik.

Critics pounced on Caribou Coffee when it was revealed the majority shareholder was a Shariah Compliant bank when it was named First Islamic Bank of Bahrain, whose CEO is Atif Abdulmalik.

According to a statement on Caribou Coffee’s website “Caribou Coffee currently has 9 directors on its board” and “the majority of whom meet all the independent requirements of NASDAQ and the U.S. Securities & Exchange Commission.”

First Islamic Investment Bank of Bahrain, which began operations in 1997, changed its name to Arcapita Bank B.S.C. March 15, 2005. The Islamic investment bank also changed the names of its US division, Crescent Capital Investment located in Atlanta. It is now Arcapita.

Arcapita Bank B.S.C. has offices in Bahrain, Atlanta, London and Singapore. The fact just the “majority” meet the requirements is concerning. It suggests the minority is not.

Financial institutions who practice SCF law have Shariah Law Advisers to guide the company and its investments. Enter Yusuf Al-Qaradawi.

Financial institutions who practice SCF law have Shariah Law Advisers to guide the company and its investments. Enter Yusuf Al-Qaradawi.

Qaradawi is a very busy man having a long standing record of fueling jihad and terrorism. Yusuf Al-Qaradawi’s name has been removed from being a part of Arcapita Bank, but it is believed he is still very much involved with Arcapita.

This man, who has been banned from entering the US since 1999 and who has a long history of promoting violence, supporting bombings of the Israeli people, funds and supports Hamas and Hezbollah and encourages attacks on American forces in Iraq and Afghanistan, is/was the Shariah Complient Financial Adviser for Arcapita Bank.

Currently Arcapita’s website list’s the following as being on its Shariah Supervisory Board:

- Shaikh Abdullah Sulaiman Al Meneea, Chairman - Member of Grand Scholars Panal, Saudi Arabia; Retired Islamic Judge, Supreme Court in Saudi Arabia; Member of Shariah advisory boards of a number of Islamic banks and other Islamic financial institutions.

- Dr. Abdul Sattar Abdul Kareem Abu Ghuddah - a SCF board member on a number of Islamic banks and financial institutions; Member of Accounting and Auditing Organization for Islamic Financial Institutions, Bahrain.

- Justice Muhammad Taqi Usmani - Vice President of Darul-Uloom University of Karachi Pakistan. Ex-member of the Shariah Appellate Bench of the Supreme Court in Karachi, Pakistan. He too is on the Shariah Advisory Board of a number of Islamic banks and financial entities.

- Shaikh Essam Mohamed Ishaq – Chairman of Muslim Education Society; Director and Shariah Adviser of Discover Islam, Trustee of Al Iman Islamic School; also member of the Shari’ah Supervisory Boards of a number of Islamic banks and financial institutions.

Arcapita Bank BSC, the owner of Irish power utility Viridian Group Ltd., filed for bankruptcy in the U.S. after failing to reach an agreement with creditors on a $1.1 billion loan due this month.

points to 365 today, according to credit default swap data from CMA, which is owned by CME Group Inc. and compiles prices quoted by dealers in the privately negotiated market.