1997 – Drs. Michael and Eddie DeRose along with Dan “put coke machines in schools” DeRose started opening dental centers to abuse children so they could defraud Medicaid, then build a football stadium in their own honor.

2001 – Dr. Tu M. Tran and Dr. Thien Chi Pham were dentists working at Smile High Dentistry in Colorado. Smiles High Dentistry is part of the Small Smiles Dental chain.

2002 – Tran and Pham were convinced to move to Atlanta and open up Kool Smiles, starting with 2 centers.

2004 – Friedman, Fleishcher and Lowe bought the centers and established NCDR, LLC to be the dental management division of FFL.

2006 – First Islamic Bank (aka Arcaptia aka Crescent Capital) gave the DeRoses $435-million for the dental centers.

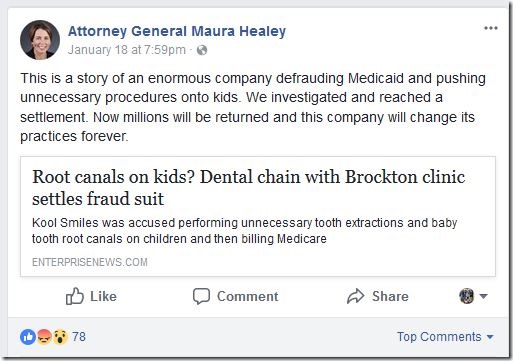

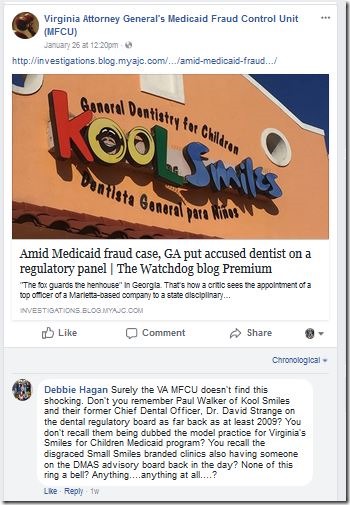

2007 – In Georgia two companies who over saw Georgia's Medicaid benefits kicked Kool Smiles out of their network of dental providers for it’s Medicaid patients. Kool Smiles said it was because Wellcare wanted to cut it’s own costs! Wellcare said it was because children being abused for profit and fraud. Georgia agreed with Wellcare, and found over 6% of all Kool Smiles patients files didn’t need the care they received and over 3% of the treatment was substandard.

2012 - We are still where we were in 2007 with Kool Smiles – children abused, substandard treatment, fraud.

With Small Smiles nothing much has moved either. Pretty close to the same as in 2003 when reports of its child abuse first surfaced – 11 very long years have passed and we are zooming toward year number 12.

Kool Smiles continued to grow to over 120 dental centers today Small Smiles topped out at 72 or 73. Hundreds of dentists, who likely worked for one of these mills, broke off and opened their own smaller versions of this business mode- Abuse and Defraud for Profit. Adventure Dental and Vision is just one example. Their “owner” also worked for a Small Smiles Dental Center.

Small Smiles alone, treats 1-million children a year.

There have been numerous news reports on Kool Smiles Dental Centers since it’s beginning. There have been at least 72 73 news reports on Small Smiles Dental Centers since 2003.

Each report, from coast to coast, contained the exact same allegations:

- Children being restrained and physically assaulted.

- Unnecessary overtreatment.

- Parents filing complaints and nothing being done.

- A State or Federal Agency is Investigating.

There have been a few letters mailed out scolding the business practices, a tiny weeny fine or two – (that has not been paid yet) and a couple of Corporate Integrity Agreements that the executives wiped their asses on. (well, it’s true!) An a few “official” reports. Personally I’m not sure what a “report” actually accomplishes.

Here is reporter, Sydney Freedberg's report for Bloomberg, published just last week!

Today is July 4, 2012 and hundreds of these little houses of horrors will open their doors tomorrow.

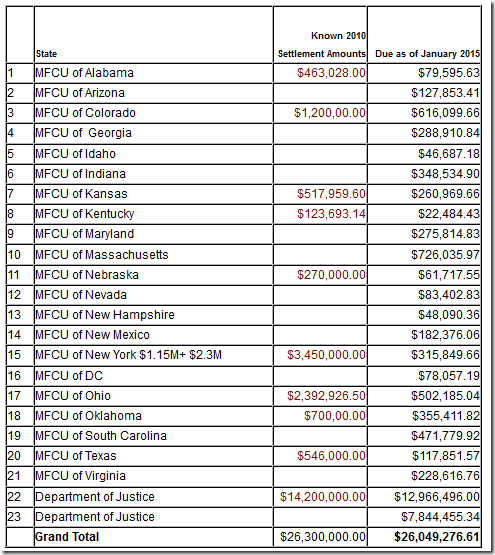

So far Small Smiles has seen:

- $24-million dollar fine they have not paid

- A 66 page Corporate Integrity Agreement they have not followed

- A few scolding letters with no bite

- A $230,00 fine – they have not paid. (the actual fines for all the violations amounted to millions, but they got a discount)

- One measly dental center in Manassas, Virginia they swear they do not own had to be transferred to a new owner

- The Oxon Hill dental center closed for two days of training! I’m NOT kidding!!

- Checks from the Medicaid fund still arriving in their bank accounts daily.

Hell, no wonder everyone wants in on the action.

CSHM Breach of Corporate Integrity Agreement March13 2012 <p> </p>

On March 7, 2012, just days after filing bankruptcy, their independent monitor did a check of the Oxon Hill Small Smiles and turned up all kinds of problems. On May 15, 2012 HHS once again sent out another letter, telling them to shut Oxon Hill down for a two day training session.

The letter stress HHS’s concern that just days prior to the March 7, 2012 monitor visits, that the Chief Compliance Officer – Lorri Steiner,- the Chief Dental Officer, Steven Adair or Gus Ghassen or both – the SVP of Operations, Kevin Reilly,- the Executive Director of Operations,Lisa Mullinix or Scott Nearing maybe- the Compliance Attorney, Sheila Sawyer, and the Regional Director, Dr. Marlene Navedo had been to Oxon Hill Small Smiles and couldn’t find a thing wrong. NOT ONE THING! How can that be???

Are they incompetent or criminals, it has to be one or the other. Are the same folks still running the show down there? Yes indeed…several of them are still there.

Something big happened that was quite serious, I don’t know what, by the Oral Surgeon at the Oxon Hill Small Smiles on February 20,2012. I don’t know if I want to know either.

CSHM Agreement with Office of Inspector General May 15 2012 Next Wednesday, July 11, 2012 is the dead line for CSHM to have reviewed and report past overtreatment at the Manassas clinic. As Bloomberg Businessweek reported, with 42% of all the root canals checked, (104 unnecessary root canals out of 244) deemed unnecessary I’m guessing that report will not look good for the dentists working there, or the company.

This company has been under the watchful eye of government regulators since 2007, when the investigation first began. Can you get your head around the fact they have not changed their ways in 5 years!!!!

Arrests next week?