|

| Dr. Michael W. Davis |

Contrasting Dental Medicaid

Enforcement: Florida versus Texas

By:

Michael W. Davis, DDS

Dr. Michael W. Davis maintains a general dental practice in Santa Fe,

NM. He serves as chairperson for Santa Fe District Dental Society

Peer-Review. Dr. Davis also provides a fair amount of dental expert

legal work for attorneys. He may be contacted via email:

MWDavisDDS@comcast.net

Introduction

Both Florida

and Texas share similarities in that both states have long standing Republican

state legislatures, state attorney generals, and state governors. Likewise,

both states enjoy highly diverse ethnic and economic population demographics. However,

each state handles enforcement of dental Medicaid very differently.

Dental

Medicaid fee schedule rates in Texas are some of the highest nationally, while

Florida’s are at or near the bottom.1,2,3 Texas has attracted a huge

bevy of corporate dental chain Medicaid providers, headquartered both in-state

and out-of-state. Florida has a paucity of such interstate dental Medicaid

corporate providers.

Although

dental Medicaid fee schedule payouts are substantially higher in Texas, both

states’ fee schedules fall below the UCR (usual and customary rates) of the

average insurance company. With dental Medicaid remunerations below the

overhead costs of most private dental practices, only a minority of licensed

dentists sign on as Medicaid providers. Those doctors who obtain Medicaid

credentialing generally do so to serve a limited number of patients on a

charity basis, or work in the public sector. There are some disturbing

exceptions.

There are a

minority of “outlier” dentists whose goal is to scam the Medicaid program, and

make little effort to cover their tracks.4-7 Added to this number

are many more devious Medicaid fraudsters, in which only skilled dentist

auditors can identify.

Florida

dental regulatory authorities have been quicker to turn over cases of suspected

Medicaid fraud and abuses to their state’s attorney general’s office. This has

occurred far less frequently in Texas, despite Texas being a far more populous

state with far greater numbers of dental Medicaid providers.

Extent and Examination of Dental

Medicaid Fraud and Abuses

We’ve

already learned from the recent limited examination (four states) by federal

Health and Human Services- Office of Inspector General (HHS-OIG), that

approximately 9-11% of dental Medicaid providers are grossly over-the-top in

abusive Medicaid billings.4-7 These specific providers are termed

“outliers”. Depending on the state reviewed, one-third to 50% is employed by

large group practices (primarily corporate dental chains called “dental support

organizations”, “DSOs”). One must remember, these are the worst of the Medicaid

program violators, and not the majority with scams designed to “fly under the

radar”. Outliers only represent the easy to identify, low hanging fruit.

Typically

the cleverer Medicaid fraudsters (non-outlier cheats) upcode Medicaid services

or provide gross over-treatment, which isn’t discovered as easily by a HHS-OIG

audit.8 One common fraud technique is upcoding of dental sealants on

permanent teeth, to multiple surface posterior resin restorations.9 Others

place multiple steel crowns on deciduous (baby) teeth, which have minimal to no

evidence of dental decay, or are soon to naturally exfoliate (naturally come

out).10,11 Another favorite

dental Medicaid scam has been the service of a pulpotomy on deciduous teeth

(baby tooth root canal), into teeth with little caries (tooth decay) near the

tooth’s nerve.12-14 In fact, the author has specifically heard this

referenced as a “preventative pulpotomy”, in interviews with former corporate

dental employees. Of course, the bitter cynicism and avarice towards the

patient’s welfare by this terminology of “preventative pulpotomy” shouldn’t be

lost on the dental profession, auditors, or the general public.

Perhaps

unique to Texas, we saw an entrenched old-boy element of the dental profession

work to alter and amend standard accepted dental terminology, to expand

Medicaid eligibility. Texas Medicaid orthodontics (corrective movement of

teeth) eligibility required “ectopically erupted teeth”. Insiders simply

changed the Medicaid definition of “ectopically erupted tooth” from the dental

industry standard definition, to include any tooth which may be malpositioned,

angled, tipped, slightly rotated, etc.15 These schemers circumvented the intent of the

law, and lined their pockets either through providing direct Medicaid services

or for-profit courses to dentists, on how to beat the system.16

An

additional component of Texas dental Medicaid fraud-by-design was Medicaid payments

not for completion of an orthodontic case, but for payments on a per-visit

basis. Obviously, financial incentive was established to continually yo-yo

patients in active treatment, in and out of a dental office. No consideration

was afforded to transportation challenges for disadvantaged children. Further, there

was a serious disincentive to complete orthodontic treatment in a timely

manner, in the patient’s best interest. In the years 2009-2011 Medicaid

orthodontic payments in Texas outstripped the payments for all other 49 states combined.17

Texas

declined to provide dental Medicaid oversight and monitoring on the state

level, and delegated this responsibility (for a significant fee to the

taxpayer) to the highly discredited Xerox Corporation.18,19 The federal HHS-OIG agreed with Texas,

that Xerox failed in their contractual obligations of dental Medicaid

oversight. However, the federal Inspector General stated the State of Texas is

ultimately responsible for the disturbingly remiss oversight.20

In fact, services

of Xerox were so egregiously lax, that’s it’s difficult to see this as anything

other than political pay-to-play. All the while, dental Medicaid fraudsters,

both large and small were free to ply their trade in fraud-craft. Texas state

authorities provided the illusionary mantle of oversight via a wasteful model

of collusion, with big business/big government crony capitalism.

The most common

Medicaid unlawful scheme of non-profit dental clinics (federally qualified

health centers or FQHCs) is via abuse of “patient encounters”.21 To

date, we’ve only see this frequent Medicaid scam addressed by government

regulators to much extent in Washington and New York.22,23 This particular abuse of taxpayer money

is a favorite with certain public health clinics, Native American title 638

clinics, and non-profit healthcare facilities. Generally we don’t see

rank-and-file healthcare providers managing this particular fraud mechanism.

Usually fraud is generated though the unlawful systems of directors and

managers (some are physicians and dentists), who enjoy very inflated salaries

and benefits, by cheating programs designed to serve the disadvantaged.

To its

credit in Texas, the non-profit United Medical Centers Board of Directors

(Maverick, Kinney, and Val Verde Counties) recently terminated employment of

their Chief Executive Officer and Medical Director after an internal

investigative audit.24 Unfortunately,

I expect another miracle from the waters of Lourdes, before I anticipate Texas

authorities to file a civil or criminal case against these Medicaid cheats

within the public sector.

One would

like to assume nonprofit organizations are distanced from scamming taxpayers.

However, that assumption has proven inaccurate and very dangerous. Schemes

defrauding the dental Medicaid program are highly pervasive, lucrative, and

relatively easy to pull off. Dental Medicaid fraud and abuses are ubiquitous

both in the private and public sectors. The largess which comes to those who

defraud American taxpayers from dental Medicaid scams has in fact become an

entrenched and fully accepted dental industry model of business.

Handling and Mishandling of Dental

Medicaid Cases

Both Texas

and Florida have historically operated under a failed enforcement model of “pay

and chase”.25,26 Medicaid payments are made to providers (or their corporate

beneficial owners, usually DSOs) year after year without question or

examination. If an audit is eventually generated, it then becomes a massive

records undertaking. Government regulators usually lack funds to retain

meaningful dentist auditors, to thoroughly review patient records and billings.

Behind the 8-ball, government prosecutors nearly always settle cases for

pennies on the dollar, and no admission of wrong-doing by violators.

By contrast,

the dental insurance industry mandates pre-authorizations prior to a provider

billing for a vast number of patient services. Questionable services and

payments are better “nipped in the bud”. Payments are better held in check, not

as easily getting out of hand.

Payment

holds from the private insurance industry generally are upfront from the onset,

on an individual case-by-case basis. By contrast, Medicaid payment holds are

usually well down the road, and may represent many hundreds of thousands of

dollars or even several million dollars. Medicaid payment holds are formulated

by deviations in billings, which are assumed to represent patterns of fraud and

abuse. Obviously, a long-term pattern of abusive billings must be established,

prior to control of taxpayer (public) monies. Private insurance companies,

which have their own set of difficulties, rarely allow fiscal problems to build

to this crisis level.

Texas

|

| Dr. Tuan "Terry" Truong |

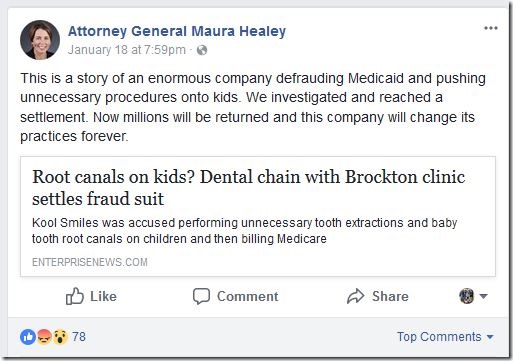

The government’s

prosecution of Dr. Tuan “Terry” Truong is a case worth examination.27

Dr. Truong was employed by Kool Smiles Dental in Abilene, Texas, for over a

year. After conviction for Medicaid fraud, Dr. Truong was fined and sentenced

to federal prison for 18-months. The statement released by Kool Smiles Dental

acknowledged their full cooperation with the government’s investigation and

prosecution. Yet, Kool Smiles Dental monitors daily production metrics for each

of their dentist providers. It seems inconceivable, corporate management didn’t

fully realize the inappropriate and unlawful activities of Dr. Truong at a very

early stage. Yet, government prosecutors were very willing to accept a low

level dentist Medicaid cheat for a guaranteed felony conviction, versus those

pulling the strings at higher levels. One is left to wonder what real rats

could be convicted, if Dr. Truong were offered a deal to finger corporate

management at the DSO level, or even private equity level.

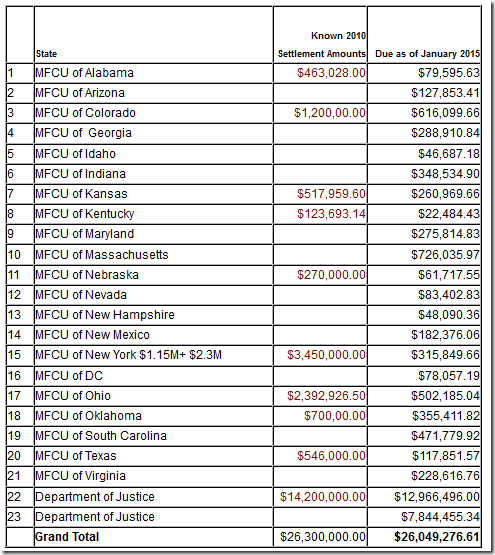

Former Texas

Attorney General (today Governor) Greg Abbott gave much ballyhoo to his

settlement deal with alleged dental Medicaid fraudster, Dr. Richard Malouf for

$1.2 million dollars.28 This settlement only represented pennies on

the dollar for the true extent of the alleged fraud (many $10s of millions of

dollars). Naturally, there was no admission of wrong-doing by Dr. Malouf,

former owner of All Smiles Dental.