Some of the highlights of the Top 20 Creditors are:

| Creditor | Amount Owed |

| US Govt toward $24 settlement | $10,714,233.36 |

| Michael G. Lindley | $859,955.27 |

| Alfred J. Smith | $674,545.81 |

| Henry Schein, Inc | $568,478.11 |

| Shary Retail, Inc, | $542,125.00 |

| Seeway Asst Mngt | $326,162.00 |

| Shearman and Sterling, LLP | $310,700.20 |

| | |

| | |

| | |

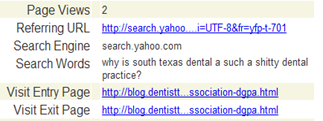

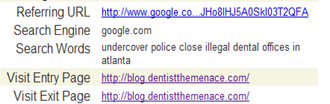

So, has this captured the attention of the other Interstate children Medicaid dental mills? You bet! Visitors to this site today come from several other corporate mills, including Ocean Dental out of Stillwater, OK.

Comment MDavis:

Yes, the Affidavit of Martin McGahan is particularly troubling in its veracity, or lack there of.

"In many cases, SSHC or CSHM has guaranteed the dental centers’ performance under those leases or assumed obligations under existing guarantees." That is the action of an OWNER, not a distanced management service organization (MSO).

On page 2, "The dental centers are owned by licensed dentists." Sorry, that simply doesn't pass the smell test either. These bogus figurehead dentists were paid an addition sum, to pose as "Owners" for State Regulatory Boards. We also realize from Case Law in Orthodontic Centers of America, Inc No. 07-30430 (Fifth Circuit (Texas) 12-30-2008) that the Court found these typical management services (from MSOs) constituted the practice of dentistry.

On page 3, "The Debtors do not own any real property." Even if the real estate is leased, the dental equipment has a tangible value, and dental equipment doesn't come cheap. This dental equipment is no longer owned by the former owner "Old FORBA" (the DeRose, et.al. group). The bogus "Lead Dentists" don't own it. It's an asset of value to Creditors.

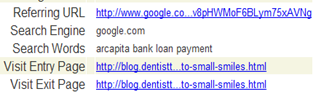

On page 4, there is mention of Shari'ah Law. This was to conform w/ the investment of Arcapita Bank. Well guess what? Under Shari'ah Codes one can't make loans, and generate profits though interest payments. An investment banking firm, i.e. Arcapita Bank, may buy into a business, then later sell off the business, hopefully generating a profit. This makes the Party buying in, a Partner in the business. They share risks, liabilities, & potential profits. So, we're now talking about potential fiscal liabilities of Partner, Arcapita Bank, and not simply CSHM.

Page 4 & 5 get more into the "dance" of compliance w/ Shari'ah Codes. Ever read the Annual Report of Arcapita Bank, & the pages directed to their strict compliance w/ Shari'ah Codes? It certainly looks like they go to lengths, to avoid issues which they seemingly hold highly ethical. Does it break w/ Shari'ah Code to be involved in business, which harms small children & defrauds the taxpayer? Heck, just read the Release of the US Justice Department, w/ the $24 Mil Settlement.

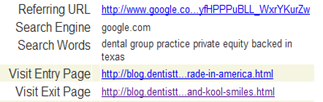

Page 7 gets into who they want to establish as First Lien. In other words, CSHM goes bankrupt, and the real owners, the investment bankers of Arcapita Bank, The Carlyle Group, and American Capital are first in line to collect. That doesn't pass the smell test either. Do you believe a Bankruptcy Court would buy into that? Representatives of these Investment Companies openly sat & served on the Board of CSHM. They were involved in business decision making, or were positioned to do so, even if they attempt to pass the responsibility.

Page 10 "The Company is party to a Management Services Agreement (“MSA”) with each dental center for which the Company provides management services (collectively the“Dental Centers”). Pursuant to each MSA, the Company provides the Dental Centers with management services such as billing and collection, bookkeeping, accounting and tax services,dentist and staff recruitment, payroll services, human resources, information technology support,equipment and supplies procurement, leasing, repairs and capital improvements, and assistance with compliance, legal issues, governmental affairs, and licensing and permitting. In exchange for providing these services to the Dental Centers, the Company receives a management fee from which it funds its operations." This is all the activity of Practice of Dentistry, and OWNER of a Dental Practice. “Dental Centers”). Pursuant to each MSA, the Company provides the Dental Centers with management services such as billing and collection, bookkeeping, accounting and tax services, dentist and staff recruitment, payroll services, human resources, information technology support,equipment and supplies procurement, leasing, repairs and capital improvements, and assistance with compliance, legal issues, governmental affairs, and licensing and permitting. In exchange f r providing these services to the Dental Centers, the Company receives a management fee from which it funds its operations." This is all the activity of Practice of Dentistry, and OWNER of a Dental Practice. They spell it out, in attempt to circumvent reality.

More later.

The attorneys will have fun over this nonsense.

Michael W Davis, DDS

Comment Debbie:

Just think, there is 35 more pages of this BS for this document. Ole Martin failed to mention, at least so far as I’ve gotten through this, that it’s management services are in exchange for 100% of the profits, and we give the owners of the clinics a flat fee of $1250 for each clinic! It’s that just a upside down and backassward way of saying, we own and operate dental centers and the dentists are our employees! Guess, the word management has taken on an all new meaning…. No, I just mange that car in the driveway for the bank. Yep, that works for me if any liability issues were to come up. LOL

Comment: MDavis

If I were a Creditor, I'd also do serious background check into real estate assets, especially the early clinics established in CO, NM, & AZ, by the DeRoses. I would not assume, at face value, all the real estate is leased. It may be leased through yet another dummy corporation, of The Carlyle Group, Arcapita Bank, & American Capital.

Yes, this takes the effort of going to County Records & Deeds. Anyone familiar w/ this blog will soon recognize certain names & titles, to have an eye open for.

In my time, I've met certain Judges, who've presided over Federal Bankruptcy Court. IMHO- they won't broker liars or BS. And, they've seen every scheme in the book. They've got a HUGE case workload, and have no time for manipulators & cheats.

The Martin McGahan Affidavit is a HUGE risk, by The Carlyle Group, Arcapita Group, & American Capital. If right from the get-go, these parties appear the schemers, which they are, the Judge is likely to get POed. And believe me, one doesn't want to be on the wrong side of a POed Federal Judge.

Michael W Davis, DDS

What would a Florida State Representative have his name on so many dental companies? Congressman Bileca is on the following either as a member of the LLC, Executive of the Corporation or the Registered Agent. He’s also the treasurer of the

What would a Florida State Representative have his name on so many dental companies? Congressman Bileca is on the following either as a member of the LLC, Executive of the Corporation or the Registered Agent. He’s also the treasurer of the